Remote Wilderness Rescue and Travel Insurance: What You Need To Know

A buyer’s guide to choosing travel and rescue coverage that actually works. We read all the fine print so you don’t have to.

A long ways from anywhere, wandering ridge lines in Alaska

OVERVIEW

Travel insurance can be super confusing. If you’re headed into remote areas of the world or mountaineering in the greater ranges it get’s even more complicated to figure out what you need.

If you’re heading into remote terrain (Alaska, the Arctic, high mountains, backcountry abroad), most people assume they’re covered when they’re not.

We spent an absurd number of hours reading fine print and calling insurance companies so you don’t have to — and we keep updating this guide as the industry changes.

If you want to be sure you’ve bought a product that actually does what you think it does, we strongly recommend reading this whole post. (Hint: most standard travel insurance policies do not cover remote wilderness rescue — regardless of what country you’re in. Yes, even the popular ones.)

Reading this could save you tens of thousands of dollars someday. Truly.

But, if you’re short on time skip to the end for my recommendations.

WHY THIS MATTERS

I generally avoid over-insuring myself. Remote rescue is the exception.

A single helicopter evacuation in the U.S. can easily cost 40K+. I work as a full-time mountain guide, so for me it’s a no-brainer. But I also strongly recommend rescue coverage to all clients, even on shorter, week-long trips.

This guide applies to anyone going somewhere remote: backpacking, mountaineering, packrafting, or anywhere a hospital is a very long way away. We’ll also be sure to cover high risk and high altitude activities and just generally try to bring clarity to a very confusing market.

FIVE THINGS ALMOST NO ONE UNDERSTANDS (BUT YOU SHOULD)

Pro Tip 1: Practically no guide company or tour operator will cover the costs of a rescue should you need one whether or not they recommend you to get rescue insurance.

Pro Tip 2: Nearly all travel insurance policies say they cover “Emergency Evacuation.” What they actually mean is that they’ll cover your transport from one hospital to another if and only if the local doctor says you need a higher level of care. The “Emergency Evacuation” does not cover the cost of getting you from the site of injury to the hospital in the first place. This kind of blew my mind. Surely thousands of people are buying these policies without understanding the meanings of these confusing terms.

Pro Tip 3: Travel insurance companies often have terrible reviews for two reasons:

Some are genuinely bad actors.

Many people never read what they bought.

Clicking “add insurance” at checkout for your flights or hotels is a great way to buy something mostly useless.

Pro Tip 4: Some rescue policies only cover you if you initiate the rescue through them.

If you don’t understand this detail before your trip, you may not be covered.

Pro Tip 5: This industry relies heavily on affiliate marketing, so many glowing reviews are… questionable.

Yes, this post has affiliate links too (awkward, right!) — but guiding is our income, not blogging. It is nice when you use our links though! You’ll just have to take our word that we tell it like it is regardless.

Disclaimer: I’ve done my best to bring clarity to a messy industry — but you are still responsible for confirming what your specific policy covers for your specific trip. We 100% recommend reading the fine print. Or drop the doc into Chat GPT and ask it to tell you any loopholes.

RESCUE VS. TRAVEL INSURANCE: WHAT’S THE DIFFERENCE?

This might get confusing, bear with me! Really we’re talking about four different things. I’m going to make up some new terms to help clarify a confusing market.

Remote Rescue: You’re injured or sick in a remote wilderness area (Alaska, Arctic, high mountains).

This covers the actual rescue: helicopters, SAR teams, logistics.

Coverage usually ends once you reach a suitable hospital.

This is what most people think travel insurance covers, but rarely does. Remember: “Emergency Evacuation” as written in the fine print of policies usually refers to transport between medical institutions. not from the wilderness.

Rescue Lite: You’re traveling internationally, get sick or injured, and need medical care or transport between hospitals.

This often covers:

Hospital bills abroad

Medically necessary flights to better care

It usually does not cover wilderness rescue.

Trip Insurance: This type of insurance reimburses you if you need to cancel a trip for an approved reason. Say you book a guided trip through Indigo Alpine Guides. Three days before you’re scheduled to go on a trip of a lifetime, you sprain your ankle so bad you can’t walk. Unfortunately, we can’t refund your money so close to departure, but if you bought trip insurance you’ll get all your money back. Many companies also offer a cancel-for-any-reason policy that will reimburse you 75% of the trip.

Combo Policies: Most policies out there (particularly the ones on the first page of Google) are combinations of Rescue Lite and Trip Insurance. They’ll coordinate and pay for your rescue and medical care (with lots of exceptions) and they’ll reimburse you if your trip gets canceled / delayed / etc. Squaremouth, World Nomads, and Safety Wing are three of the biggest players here.

SO WHAT SHOULD YOU GET?

Traveling internationally, not remote?

→ A combo policy probably makes sense.Spending time in remote areas (U.S. or abroad)?

→ Get dedicated remote rescue coverage.Remote adventures abroad?

→ Get both remote rescue coverage and a combo policy.

Clear as mud? Perfect. The rest of the post hones in on:

Remote rescue insurance

Trip insurance

Mountaineering / high-risk coverage

👉 Or skip to the end for my recommendations.

DO I ACTUALLY NEED RESCUE / TRIP INSURANCE ?

(Before I go any further, let me say that I do get a small commission from Global Rescue (at no extra cost to you) if you use my affiliate link. If you appreciate the article, please do use my link!

Whether you need Rescue or Trip Insurance for your remote expedition comes down to a few factors.

First a note on guided adventures. Many people go on guided adventures just assuming the guide company’s insurance would kick in and cover a rescue. For the vast vast majority of guide companies that is not the case. But for whatever reason companies don’t always make this obvious, and so many people go on trips unknowingly uninsured.

Do I Actually Need / Want Remote Rescue Insurance?

Are you traveling in your home country or abroad? In America, many rescues happen for free. But also many don’t. It’s a bit of a mystery to figure out what a hypothetical rescue would cost you in this country. I don’t like to gamble with that situation, so I choose to ignore all the stories about free rescues and keep insurance anyway. If you’re traveling abroad and remote, then the probability you want insurance goes up.

Would a surprise 40k USD bill (or much higher if you need international cross-border medically-supervised transport) be devastating to you or just inconvenient? Really this is what it most comes down to… your personal finances and risk tolerance.

Will you be more relaxed and more able to enjoy the massive wilderness knowing that you’re covered in the unlikely chance you need a rescue?

Are you doing extreme activities that have a high likelihood of moderate to serious injury?

Trip Insurance

This one is really just a financial question. How bummed / negatively impacted would you be to lose all the money you spent on your upcoming trip due to injury, illness, etc. Just this last summer I had two folks both get really sick right before a scheduled expedition. On my recommendation they had bought, (several months prior) a trip insurance policy for $260 for both of them. As a result they got the full $9000 for the trip back. Pretty sweet. Generally the longer you wait to buy trip insurance the more expensive it gets. Some companies won’t sell it to you at all more than a month after you’ve put money down for a trip. Buy it right when you book your trip.

A SUPER IMPORTANT NOTE ABOUT DEVICES IN THE AGE OF STARLINK

Rescue insurance only helps if you can actually call for help.

With more phones offering satellite messaging, it’s reasonable to wonder whether you still need a dedicated device like an inReach or Zoleo.

My take:

If you regularly travel beyond cell service → yes, absolutely get one and pay for the base plan.

If you don’t → you can probably save the money.

This isn’t really about satellite tech reliability. It’s about failure modes.

Phones:

Have fragile screens

Drain batteries fast in cold

Are easy to drop, lose, or break

Dedicated satellite devices:

Are rugged and waterproof

Have long standby battery life

Are built for exactly one job: getting a signal out when things go wrong

From firsthand experience: realizing you need an inReach and don’t have one is a uniquely awful feeling.

REMOTE WILDERNESS RESCUE POLICIES I RECOMMEND

The Gold Standard, but with newer products market, overkill for many. If I was in a fucked situation I would be thanking god I’d kept my global rescue policy on auto-renew.

Best for people on a budget who already have an inReach and don’t do extreme sports or go above 5000m

A newer player with a really strong offering. They offer broader, more sensible coverage than anyone else for a cheaper cost.

Overwatch x Rescue

Overwatch offers an unbelievable policy. Like, what? 24/7 rescue coverage worldwide with no risky sports or high altitude exclusions for $80 / year and you can use it with any satellite communicator or phone. The OXR product has been active since 2021 so it’s fairly new, but their parent company Focus Point has been in business for emergency response management since 2011. If the OXR plan stands the test of time (and they stay financially solvent) they’re the hands down winner for everyone across the board.

If you’re comfy trusting a newer company, their policy rocks even in the fine print. You can use the code INDIGOALPINE15 for 15% off a new policy.

Some highlights:

There are no exclusions for sports or altitude (wild!). However, the policy does not apply in the Arctic or Antarctic regions.

The policy is device agnostic. Any device will do. They prefer you to text them first, but if you MUST hit the SOS button you’re still covered.

If you get rescued without being able to contact them you have 96 hours to let them know. If you’re in a coma or something that prevents this from being possible, this stipulation is waived.

They have some cool perks like: If you have a car at the TH they’ll get it back to where it needs to get. They’ll take care of your kids if your kids are with you. They’ll fly out a family member if you end up in the hospital for a long time.

Some notable exclusions:

Overwatch x Rescue will extract you based on medical necessity at their sole discretion. That’s what’s in the contract at least. But when I spoke to them they said they will gladly rescue people (and have) who need rescuing regardless of “medical necessity” ie sprained ankles, being lost, etc.

No coverage if the emergency occurs while you’re under the influence of alcohol or non-prescribed drugs. That doesn’t mean “one beer at dinner” automatically voids coverage — but it does give them an out if intoxication contributed.

Global Rescue

Global Rescue is the absolute best rescue insurance money can buy from a publicly available policy. If I was stuck on a mountain in Tajikistan with a broken leg, I would really wish that I’d kept my Global Rescue sub active.

They have the fewest exclusions of any policy.

They have a super skilled in-house team of rescue professionals who will coordinate your care.

They will make sure you receive the highest standard of care possible.

They have a much better track record of paying claims than most other providers.

You MUST initiate rescue by contacting Global Rescue first. They will not reimburse you for a rescue they didn’t help coordinate.

They are a lot more expensive than Overwatch, but unlike Overwatch, they’ve proven themselves over many decades.

Here’s the BIG fine print difference:

Global Rescue can extract you based on situational need.

Overwatch x Rescue will only extract you based on medical necessity.

Those aren’t always the same thing.

A sprained ankle might not be medically urgent, but it can make a 30-mile walk out completely unrealistic. When I called OXR they said this isn’t an issue… they regularly rescue people based on situation need not just medical necessity. I really like their team and 100% take them at their word. But much as I like them… I go by fine print.

Buying a global rescue policy through this link helps me out a bit and cost you the same!

Garmin InReach Insurance

If you already own an InReach and just need remote rescue (not trip insurance), then get the SAR 100 plan. It’s pretty cheap at $40 / year for 100k in coverage.

They also have the SAR High Risk Policy ($299) for folks doing risky things like base jumping and paragliding. Or the SAR High Altitude Plan ($999) for folks going above 5000m. But we don’t recommend those policies (there’s better options out there).

You need to buy a separate individual policy for each person who you want covered.

To be covered, you must trigger the rescue using any InReach device (doesn’t have to be yours)—calling 911 from a phone won’t count.

The downside? Well… if you need an evac for a non-emergency you’re on your own. It would usually be unwise to press SOS just for an annoying and painful ankle sprain, but you may still want to be done walking. You’ll have to self coordinate evac in that case and pay out of pocket.

POLICIES I DON’T RECCOMEND

RIPCORD

Ripcord is really the only established competitor to Global Rescue and people often wonder which is better. Basically Ripcord combines Global Rescue type services w/ trip cancelation insurance. Theoretically this is convenient… you get to purchase one policy instead of two.

Unfortunately, I can’t recommend them.

For one thing, they quoted me $380 for a 10 day trip in Alaska. Global Rescue was $180 for the same exact trip. For $360 you could have a Global Rescue annual policy. Yes, with Global Rescue you then have to go buy trip cancelation insurance if you want it… but even then (in the case of this 10 day trip) the combined cost would have been less than ripcord.

Global Rescue has a much longer track record with a lot more available reviews. And most importantly to me, when I called Ripcord… they simply couldn’t or wouldn’t answer most of my insurance questions. Your mileage may vary… but I found it frustrating.

PUTTING YOUR HEAD IN THE SAND AND 🤞

I don’t recomend buying a policy and hoping for the best. Insurance companies thrive and die in the fine print.

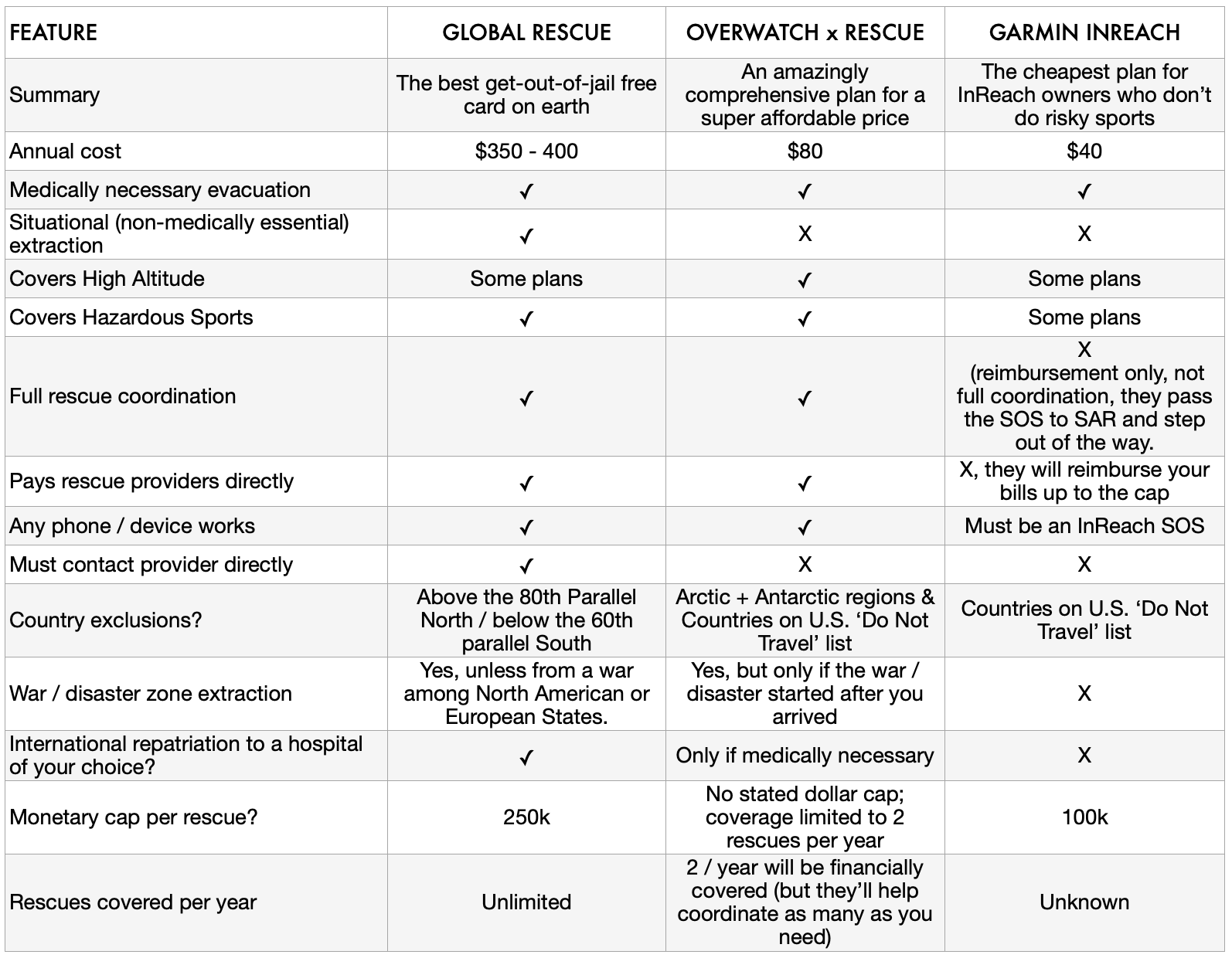

RECOMENDED POLICY COMPARISONS

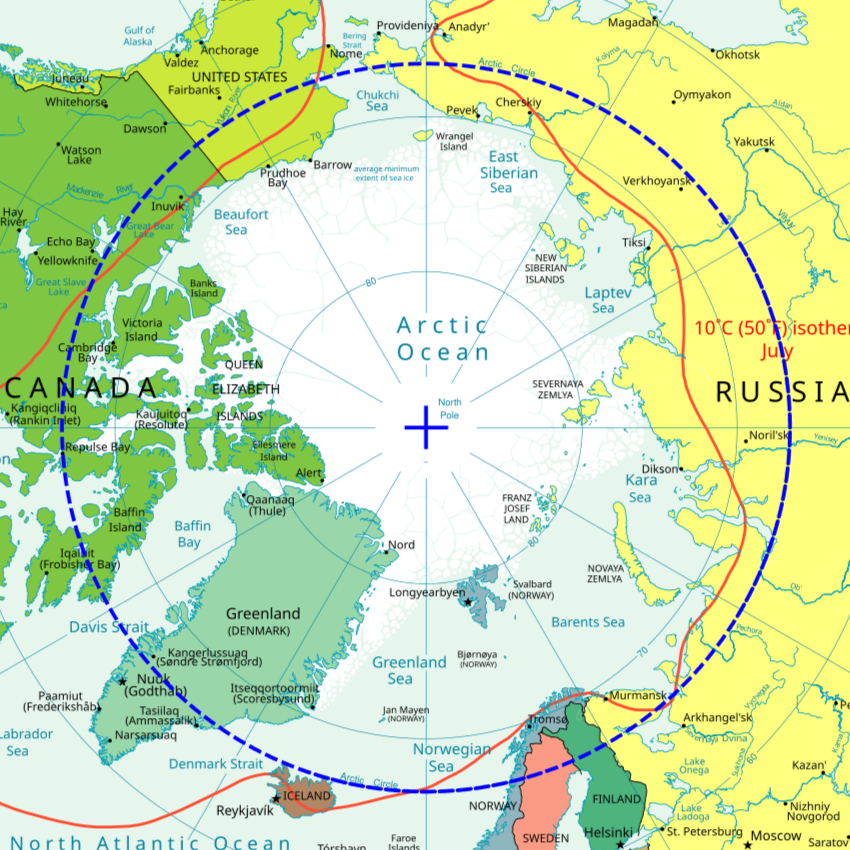

For trips to the Far North or Far South

One important difference between Global Rescue and Overwatch Rescue: OXR excludes the arctic regions. GR excludes the terrain above the 80th parallel North / below the 60th parallel south. These sound similar but are pretty different. In the image below the blue dashed line shows the arctic circle, while the innermost circle shows the 80th parallel. If relevant for you, search for a similar map for the antarctic region.

In other words if you’re coming on a trip with Indigo Alpine Guides to Gates of the Arctic or ANWR you need a Global Rescue Policy. For all other trips, Overwatch Rescue works great.

TRIP CANCELATION POLICIES I RECOMMEND

Squaremouth

Squaremouth has their own policies under their brand TinLeg, but they also are an aggregator of insurance policies in the way that Kayak is for flights. Except that unlike Kayak, they vet every company policy they allow on the site. In a sketchy industry… I find Squaremouth to be a breath of fresh air. For trip cancelation insurance, I recommend checking them out and comparing policies to see what the best deal is for your specific trip.

Global Rescue / IMG

They are honestly pretty expensive in this category. But if you’re already using them for rescue insurance and want a super comprehensive policy that won’t nickle and dime you should you actually need to use it this a great way to go. Global Rescue contracts with IMG. You can purchase it alongside Rescue Membership as an add on on the Global Rescue site.

TL;DR WHAT RESCUE INSURANCE POLICIES SHOULD I GET FOR MY REMOTE WILDERNESS TRIP?

REMOTE RESCUE INSURANCE

🥇 Overwatch offers an epic plan for an incredibly affordable annual cost. You can use the code INDIGOALPINE15 for 15% off a new plan.

🥈 Global Rescue It gets you out when the situation demands it. No matter what. And covers more of the arctic regions (but not all!) than Overwatch.

🥉 Garmin will reimburse your rescue costs after the fact — if you pressed the right button.

The biggest reason to choose Global Rescue or Overwatch over Garmin is active oversight.

With Global Rescue and Overwatch, a dedicated operations team stays involved from the moment you request help until you’re safely in medical care. They track the situation, coordinate with responders, and manage the process end to end.

Garmin (and Apple) works differently. They relay your SOS to the appropriate local SAR team, then step back. They don’t manage the rescue, prioritize your case, or oversee what happens next. That doesn’t mean help won’t come, but it does mean there’s no single organization responsible for managing the process from start to finish. If that SAR team is understaffed or already on a different mission, your need might get lost in the sauce.

The biggest reason to choose Overwatch over Global Rescue is cost and simplicity.

$79 a year for what they’re offering is wildly affordable… and way cheaper than Global Rescue. And they’ll cover you even for rescues where you’re unable to contact them directly.

The biggest reason to choose Global Rescue over Overwatch is track record.

Global Rescue has been doing this for decades and has handled thousands of real-world extractions across every continent. Overwatch’s parent company Focus Point International has been around since 2011, while Overwatch the consumer product has existed since 2021. Global Rescue has been offering a consume product since 2004.

TRAVEL / TRIP CANCELATION INSURANCE

🥇 IMG policies through the Squaremouth site. We’re not affiliated, but they do a good job of filtering out BS companies. And they’ll support you if a company refuses to pay a valid claim.

🥈 Any policy from the Sqauremouth site.

BONUS: BEST SUPPLEMENTAL ACCIDENT COVERAGE

BLISTER +

If you either don’t have health insurance or have a high deductible plan, you might consider getting this policy. For $395 a year you get accident insurance up to 25k with no deductible. The insurance covers a pretty big range of activities, but not the usual suspects (paragliding, etc). Only valid in the U.S.

FAQ

What if I’m backpacking, but not in remote areas?: This is where World Nomads and similar companies do thrive.

What if I’m Backpacking in the northern parts of Alaska?

Global Rescue and Garmin will cover you. Overwatch will not.

What if I’m mountaineering above 5000 meters or doing extreme sports?: The cheapest option is definitely Overwatch x Rescue. Or you can get the Garmin InReach SAR High Altitude Policy or the Global Rescue extreme sports add on.

What if I like doing dangerous sports like paragliding or basejumping?

Overwatch x Rescue includes these. Otherwise read the fine print of any policy carefully.

What if I need a non-medical / non-emergency evac? Maybe you just got in over your head on the trip or you got really homesick and want to leave early. As far as I know there aren’t any insurance policies that will cover you in these sort of scenarios. The best thing is to contact a local pilot directly.

What if i’m working (as a guide, journalist, influencer, etc) ?

Global Rescue and Overwatch will cover you. Garmin will most likely not.